What Does Tail Coverage Mean In Insurance

Also referred to as an extended reporting period tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse. This coverage is also known as an extended reporting period.

2012 Chevrolet Cruze 4dr Sdn Ls Chevrolet Cruze Cruze Car Insurance Rates

That is when the price of the coverage plateaus and the yearly renewal costs stay the same or possibly drift lower unless you have a claim or the insurance company raises rates.

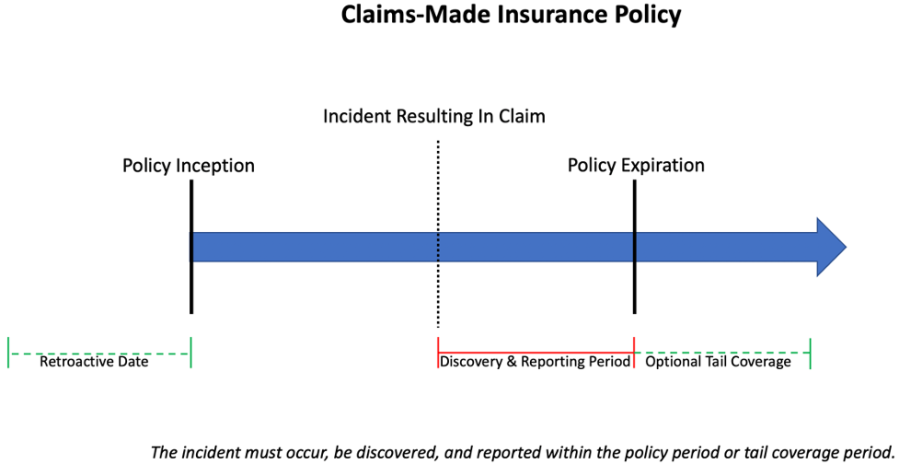

What does tail coverage mean in insurance. It applies to claims-made insurance policies and typically involves paying your insurer an additional fee. In other words its the price you pay to convert a claims-made. Purchasing tail coverage for a specific time period does not reinstate the policys aggregate.

The topic of tail malpractice insurance coverage. Simply put it refers to a policy that covers damages involving a vehicle that has detached its trailer or has unloaded its business cargo and is driven for the purposes of mobility like driving it home. Tail coverage Malpractice A malpractice insurance rider or supplement to a claims-made policy that provides coverage for an incident that occurred while the insurance was in effect but was not filed by the time the insurer-policyholder relationship terminated.

Bobtail liability insurance is a type of vehicle liability coverage that covers a vehicle when not in use for business purposes. Doctor As insurance policy is in effect from January 1 2010 through December 31 2020. The tail provides coverage for any claims from services rendered while the policy was in effect.

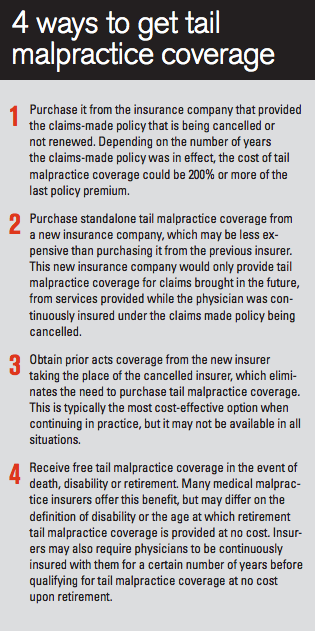

Tail coverage or tail insurance is a general concept that is utilized to extend the claims made reporting time on claims made policy forms of medical professional liability policies. See Malpractice Statutes of limitations. Think of tail coverage as a liability insurance extension plan.

What Does Bobtail Liability Insurance Mean. However the extension only applies to wrongful acts that happened while the malpractice insurance policy was still in force and it does not apply to wrongful acts that occured after the malpractice. Here is an example of how tail coverage works.

In contrast to a standard policy tail coverage provides protection for medical malpractice claims that are reported after the providers policy expired or was cancelled. Long-tail liabilities are likely to result in high incurred but not reported IBNR claims because it may take a long period of time for the claims to be settled. It gives your business protection for claims that are reported after your insurance policy ends.

A claims made policy requires that a current policy be in place if any claim is to be accepted by an insurer. But price shouldnt always be the deciding factor when choosing a plan andor deciding to change insurance companies. Thats where tail coverage comes in.

Tail coverage extends the reporting period of malpractice insurance so that medical practitioners can report a wrongful act even after their malpractice insurance lapsed or was cancelled. Be aware that. Everything Physicians Should Know About Tail Malpractice Insurance Coverage.

With tail coverage youre still insured if a claim is filed against you after the policy ends. When the policy expires or is cancelled so does the coverage. What does long tail mean in insurance.

Tail coverage is also known as an Extended Reporting Endorsement and it can be purchased or earned when terminating a claims-made policy. For Individuals For Practices Blog About. Is Tail coverage a one time fee.

This policy endorsement is also known as an extended reporting period. Tail coverage applies for a limited time period generally 1 year. Tail Coverage a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took during the expiredcanceled policy.

Without prudent deliberation following a change in control or policy non-replacement individuals may be. Tail coverage in malpractice insurance enables you to report claims after the policy period has ended. Your ERE wont cover new events from part-time work or moonlighting while in retirement.

Tail coverage applies only if the wrongful act giving rise to the reported claim took place during the expiredcanceled. Run off insurance is an important consideration for an organisation and its management when considering long-tail exposures. 0 February 7th 2012 Whether carrying medical malpractice insurance on your own as a private practice physician or as an employee of a group or hospital tail coverage should be a top priority when considering any changes to your coverage.

Runoff insurance is an insurance policy provision that covers claims made against companies that have been acquired merged or have ceased operations. Tail coverage which is purchased from the expiring carrier at the time a claims-made policy is cancelled offers coverage for incidents that occurred while the policy was still active but which were not actually reported to the company until after the policy was canceled. This coverage allows the insurance carrier to respond to any claims arising after the policys termination date for a claim that occurred while the policy was active.

An ERE might be a good idea if you are just moving from one law firm to another firm or one hospital to another one. Tail coverage is an endorsement also called a rider typically found within a claims-made policy such as errors and omissions insurance EO or directors and officers insurance DO. Prior acts coverage typically gets sold in the context of liability insurance which protects entities from suffering legal repercussions for certain activities they undertake that inadvertently.

What does it mean for a policy to mature. Tail coverage is a part of how your business insurance coverage works if its written on a claims-made form. Tail coverage is also a type of endorsement on your last active policy so you arent purchasing new insurance.

A long-tail liability is a type of liability that carries a long settlement period. Heres how tail coverage works and what it costs. Tail coverage is an endorsement or an addition to your insurance that allows you to file a claim against your policy after it expired or was canceled.

Pin The Tail On The Doctor Medpli Professional Liability Insurance

Zipquote We Ve Got You Covered Buick Cars Buick Riviera 1965 Buick Riviera

Curly Tail Leopard Gecko Leopard Gecko Cute Reptiles Cute Gecko

What Is E O Insurance Tail Coverage And How Does It Work In Real Estate Vaned

2020 Physician S Guide To Tail Insurance Medpli Professional Liability Insurance

Do You Need Malpractice Tail Coverage

Legal Malpractice Insurance What Exactly Is Tail Coverage And How To Know If You Need It Oamic

Know All About Tail Coverage Before You Take That Job Today S Hospitalist

Honda Cbr 1000 Fotos Y Especificaciones Tecnicas Ref 146855 Honda Cbr 1000rr Sports Bikes Motorcycles Honda Cbr

Tail Insurance For Medical Malpractice Policies Tail Coverage For Doctors

Claims Made Prior Acts And Tail Coverage

Geico Mascot Geico Car Insurance Pet Insurance Geico

Tail Insurance Faqs Aegis Malpractice Solutions

Tail Insurance Faqs Aegis Malpractice Solutions

Tail Insurance Coverage What Is It Landesblosch

Russians Come Turkey For Medical Tourism As Well Http Www Portturkey Com Health Care 1854 Russians Come Turkey Medical Tourism Turkey Turkey Tail Mushroom

Picture Desk Live The Best News Pictures Of The Day Animals Animals Beautiful Animals Wild

What Is Tail Insurance Medpli Professional Liability Insurance

Posting Komentar untuk "What Does Tail Coverage Mean In Insurance"