Qualifying Event To Drop Insurance Coverage

ONLY at that time can you drop coverage without providing proof of other employer or marketplace coverage. Voluntarily dropping coverage is not considered a qualifying event for purposes of COBRA.

Benefits A Z Qualifying Life Event Financial Benefit Services Employee Benefit Solutions

Your spouses coverage has changed.

Qualifying event to drop insurance coverage. This would be permissible if the plan allows for this provision. Ad Info about Event Coverage Insurance on Seekweb. The Size of Your Company.

Yes you can drop health insurance at any time. However it is essential to keep in mind that once you drop your health insurance you would not have the option to get it back again until the next open enlistment time frame. Voluntarily discontinuing health insurance does not qualify as a life event to make.

Eligible dependents can take advantage of a qualifying life event to modify or elect new coverage. You just got married. Is voluntarily dropping coverage a qualifying event.

You will either need to wait for a qualifying event reaches age 26 gets coverage through another plan other than a private plan etc. You or a dependent lose job-based coverage. Heres a list of valid reasons for canceling your insurance coverage outside of Open Enrollment.

If you need new health insurance outside of the Open Enrollment Period youll need proof of a qualifying life event ie. You just had a baby or adopted a child. The husband covers the entire family through his employer but in June the.

In other words you wont be forced to take Medicare provided youre still employed. Qualifying events in health insurance are events that alter the amount of health insurance you need or change what health policies you can purchase. Your employer may not be allowing you to drop your dependent mid-year during their plan year.

A qualifying life event is a change in an individuals life that makes it possible for them to update health insurance benefits outside of the open enrollment period. You can drop your insurance coverage at any time. In order to drop coverage outright you will need to wait for the plans open enrollment period.

Your employer is required by law to keep covering you for medical healthcare costs regardless of your age as long as you continue to work. A husband has open enrollment in December each year. In the individualfamily market in most cases this includes on-exchange or off-exchange coverage qualifying events include.

However if you cancel your health insurance policy you may not be able to enroll in a new policy until the Open Enrollment Period. After a qualifying life event you have a period of 60 days to change your health insurance plan or enroll in a new plan. Do You Need A Qualifying Life Event To Cancel Health Insurance.

This can be during. 1 Loss of employer health insurance coverage 2 Expiration of coverage under COBRA or state continuation of coverage provisions 3 Loss of government sponsored plan including Medicaid or CHIP 4 Loss of Minimum Essential Coverage. When an employee has a qualifying life event they can update their plans during a special enrollment period which is generally 60 days after the date of the event.

Changes related to a qualifying event only allow dropping coverage in favor of another plan and proof of that other plan is needed. During these periods you are allowed to choose a new health policy or update your existing insurance coverage. Dropping health insurance without qualifying event You can drop your individual medical coverage plan without a qualifying life event whenever you want to.

A wife has open enrollment in June. Letter from employer stating loss of coverage and reason s why. They can also cancel their plan coverage if a qualifying life event occurs.

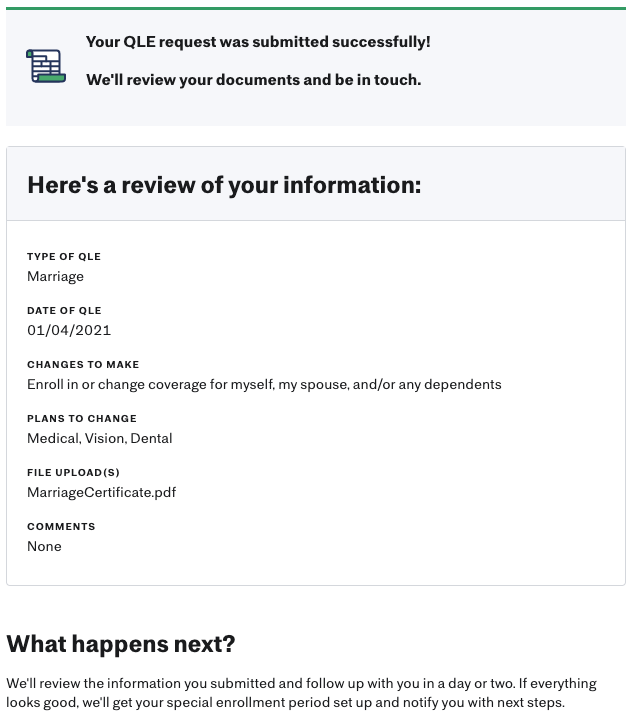

Termination letter from employer or. A Qualifying Life Event QLE allows you to purchase health insurance or change coverage outside of the Open Enrollment Period for the current plan year. Having a baby or adopting a child If an eligible worker has a baby or adopts a child they can usually add their child to their insurance policy within 30 days of birth.

These are called qualifying life events. Youve just finalized a divorce. There are 4 basic types of qualifying life events.

Its currently your spouses Open Enrollment period. Ad Info about Event Coverage Insurance on Seekweb. A special enrollment period follows significant life events like childbirth or adoption marriage or divorce unemployment or.

A qualifying life event is a requirement for access to special enrollment periods. The following are examples not a full list Loss of health coverage Losing existing health coverage including job-based individual and student plans Losing eligibility for Medicare Medicaid or CHIP Turning 26 and losing coverage through a parents plan Changes in household. There is no special event or reason necessary to do this.

Qualifying events recognized under the provisions of the Affordable Care Act ObamaCare are. A major change to your lifestyle or household. Your spouse got a new job.

If you experience one of these life changes and you have proof of loss of coverage of health insurance youll be eligible for a 60. Birth or adoption of a child marriage and divorce if the exchange or insurer counts it as a qualifying event or if the divorce triggers a loss of other coverage. For off-exchange plans some insurance companies do not require proof of a qualifying event.

For dependent children these same qualifying events apply plus one additional event the childs aging out that is the childs loss of dependent status under the plans terms. For purposes of the plan the parent wishes to drop the son from coverage since he has other insurance. If you elected coverage for this dependent and then changed your mind you will need to wait for a qualifying event.

Normally once you sign up for health insurance through your employer and agree to have your premiums deducted from your paychecks you cant drop coverage during the. We can also help you compare plans if you need coverage to help hold you over until the Open Enrollment Period. Most eligible qualifying events cause you to lose your current health coverage.

If you need to cancel your health insurance policy contact your HealthMarkets agent or give us a call at 800 304-3414 and we can help you with your options. You also may be able to choose a plan up to 60 days in advance of some qualifying life events.

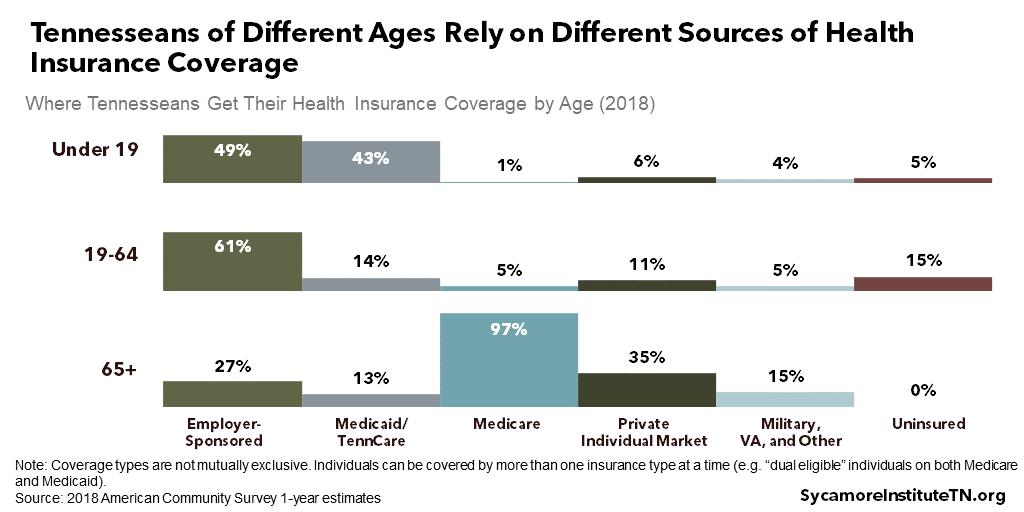

A Deep Dive Into Health Insurance Coverage In Tennessee

Qualifying Life Events Justworks Help Center

How To Make Changes To Your Health Plan

Health Insurance For Unemployed Individuals What Are Your Options Healthmarkets

How To Drop Health Insurance Coverage Understanding Your Options

How To Sell Insurance As A Self Employed Agent Agent Employed Infographic Insurance Life Insurance Facts Life Insurance Marketing Life Insurance Quotes

Health Insurance Marketplace For Employers In 2021 Health Insurance Quote Best Health Insurance Marketplace Health Insurance

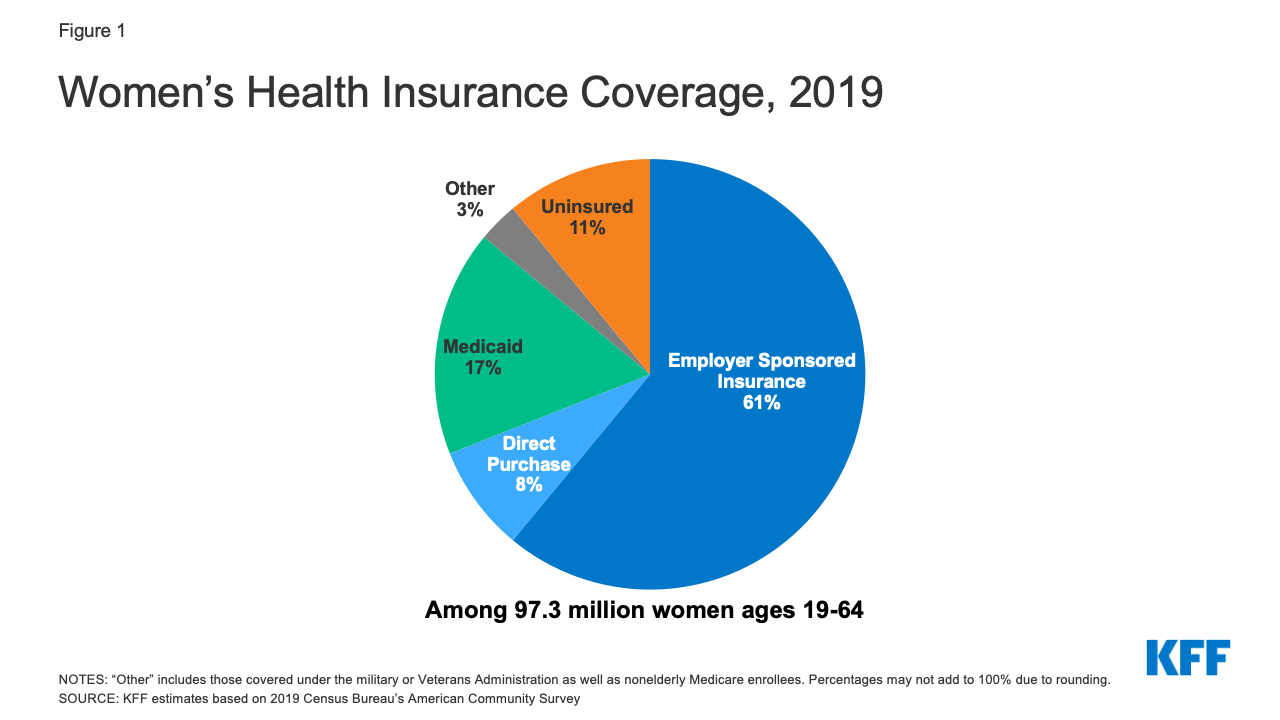

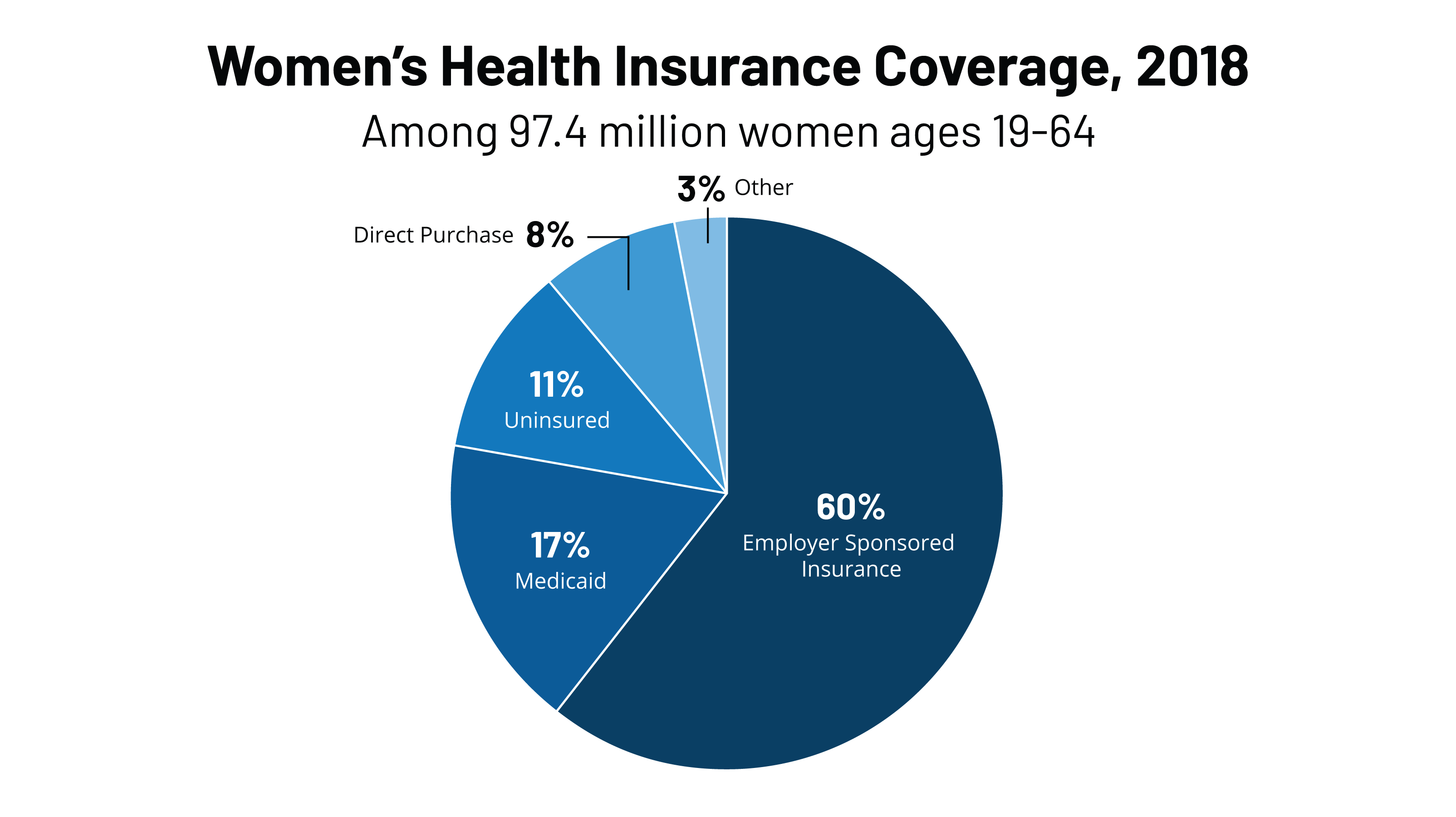

Women S Health Insurance Coverage Kff

Insurance Options For 26 Year Olds In California

Bajaj Allianz Health Insurance Offers Affordable Health Insurance Plans In India Get Medical Insurance Pol Health Insurance Health Insurance Plans Health Plan

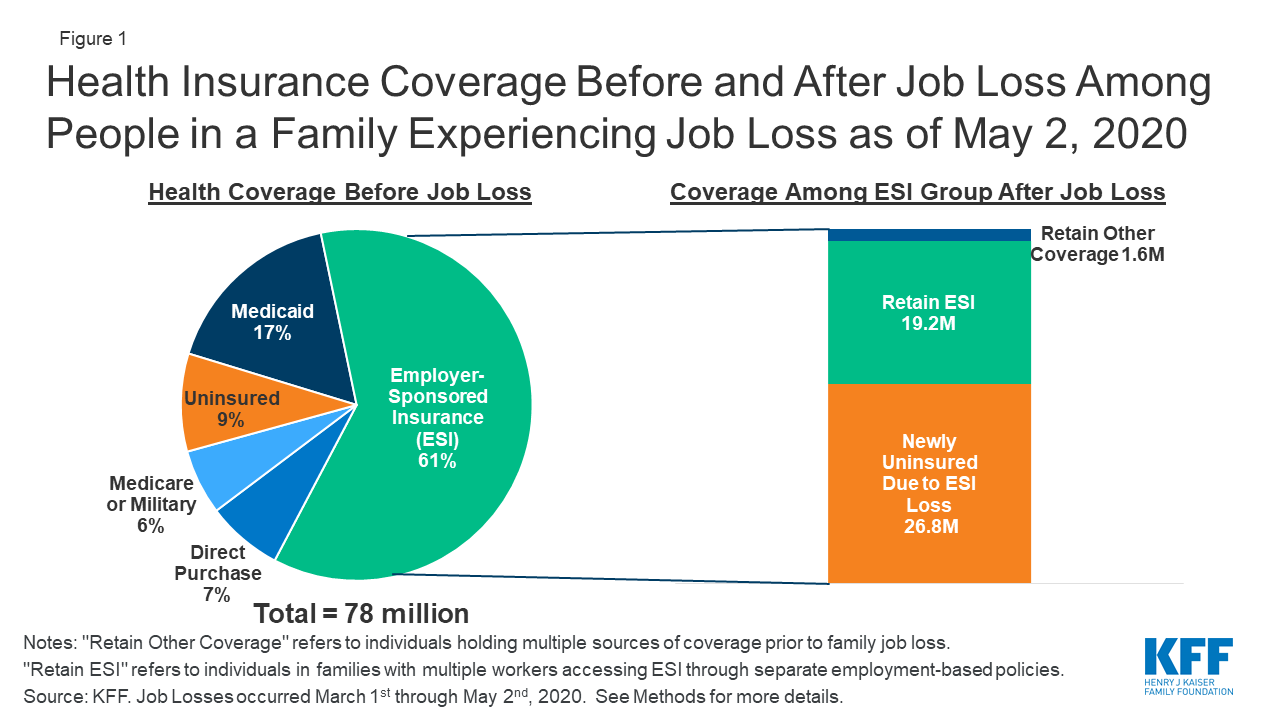

Eligibility For Aca Health Coverage Following Job Loss Kff

State Coverage For Telehealth Services Telehealth United States Map Medicaid

Image Result For Open Enrollment Posters Open Enrollment Enroll Now Poster Flyer

Qualifying Life Events Special Enrollment Periods For Health Insurance Goodrx

Women S Health Insurance Coverage Kff

Qualifying Life Event Special Enrollment Period Under Obamacare

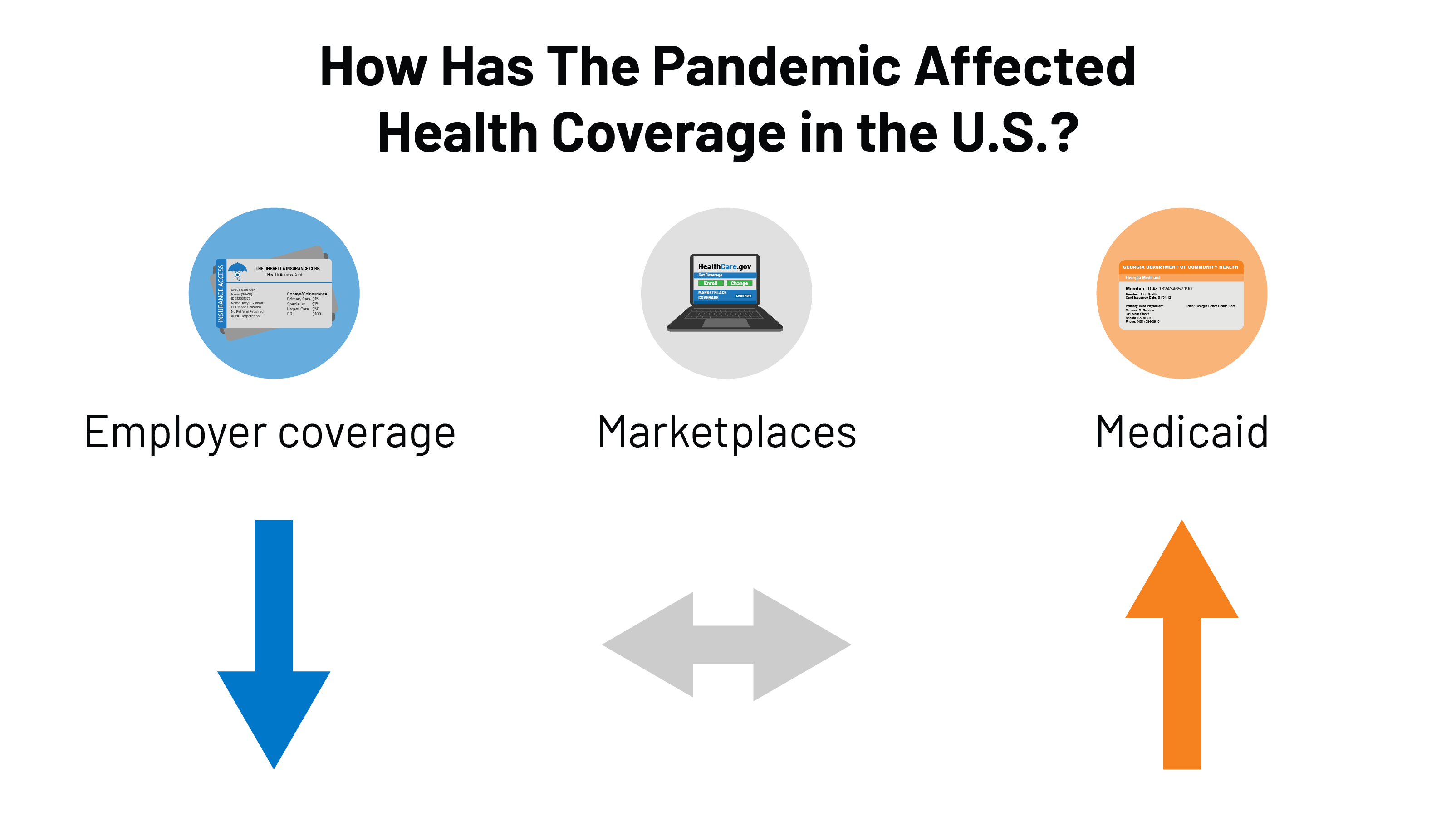

How Has The Pandemic Affected Health Coverage In The U S Kff

Why Do I Need To Provide Proof Of A Qualifying Event

What Employers Need To Know About A Qualifying Life Event

Posting Komentar untuk "Qualifying Event To Drop Insurance Coverage"