Combined Ratio Insurance Coverage

Insurers can have an underwriting loss a CR of more than 100 percent but still be profitable b ecause of investment income. 1 A combined ratio CR is the measure of underwriting profitability in insurance calculated using the sum of incurred losses and expenses divided by earned premiums.

2020 Insurance Year In Review And The Impact Of Covid 19 Expert Commentary Irmi Com

The combined ratio is calculated by dividing the sum of claim-related losses and expenses by earned premium.

Combined ratio insurance coverage. A combined operating ratio over 100 indicates unprofitable underwriting results. Insurance companies however dont just make money from charging their customers premiumsrevenue also comes from investment income in stocks bonds the core business of selling. Theres also a loss ratio which is specific to premiums and payouts without regard to operating and other expenses.

With claims-made covers which are renewed losses which occurred during any period when the policy was inforce are covered if reported during the renewal term. All the other companies in the list saw their direct premiums increase in 2018 except Nationwide Mutual Group and The Hartford Financial Services Group Inc which saw. For example the cyber combined ratio in the United States increased by more than 20 percentage points to 954 in 2020 from 745 in 2019 mainly.

When applied to a companys overall results the combined ratio is also referred to as the composite or statutory ratio. The combined ratio which is the sum of claims and expenses incurred divided by premiums earned is a measure of profitability used by insurance companies to see how efficiently they are running. Once the policy period is over the approximate extent of the insurers liability is known.

Although the rise in claims frequency in 2019 pushed up the loss ratio for the US. Before we demonstrate what to look at when studying this ratio we will first explain how it is calculated. The insurer posted a combined ratio of 986 and direct written premiums of 308 billion.

Used in both insurance and reinsurance a combined ratio below 100 percent is indicative of an underwriting profit. This ratio just doesnt seem to apply to Life Insurance Companies what is the best measurement of a life insurance companys profitability. We can calculate the combined ratio by taking the sum of the incurred losses and expenses and then dividing them by the earned premium.

Once youve calculated the ratio youll need to find ways to improve profitability. Cyber insurance market at an estimated 745 the sectors combined ratio remains in profitable territory. The combined ratio is a measure of profitability used by an insurance company to gauge how well it is performing in its daily operations.

The process of reviewing applications submitted for insurance or reinsurance coverage deciding whether to provide all or part of the coverage requested and determining the. The Combined Ratio also known as Combined Operating Ratio or COR is an indicator of how much EARNED PREMIUM is consumed by claims and expenses. The companys personal line of coverage was fine with a combined ratio of 946.

The combined ratio formula is a formula used by insurers to determine how profitable they are. The combined ratio is a simplified measure used by an insurance company to evaluate its profitability as well as financial health as a way of measuring its day-to-day performance. Combined Ratio Insurance Definition.

The combined ratio is an important aspect of any insurance carrier that brokers study in order to better service their clients with their medical malpractice insurance policy. However its property line of coverage was hit hard posting at a. Date of the coverage and prior to the end of the policy term or funding period.

The 2020 statutory combined ratio in the Best report986was higher than the GAAP ratios of 963 and 95 in the Fitch and Moodys analyses but like Moodys AM Best reported a slightly. A combined ratio can be GROSS before reinsurance in which case the earned premium and claims are gross of RI or it can be net in which case the claims are net of recoveries and the premium net of RI. A combined operating ratio below 100 indicates profitable underwriting results.

Combined ratios are seen as a good measure of an insurance companys financial health because they examine profitability only from the standpoint of the companys insurance operations. Ie the combined ratio equivalent. Aons estimated combined ratio for 2019 is comprised of the 449 loss ratio and a 296 expense ratio.

PC and Health companies use the combined ratio to measure the profitability of an insurance company to indicate how well it is performing in its daily operations.

2018 Commentary On Year End Financial Results Iii

2020 Insurance Year In Review And The Impact Of Covid 19 Expert Commentary Irmi Com

How To Reduce Insurance Claims Leakage And The Loss Ratio Via Standardization Business Intelligence And Robotic Process Automation Rpa The Lab Consulting

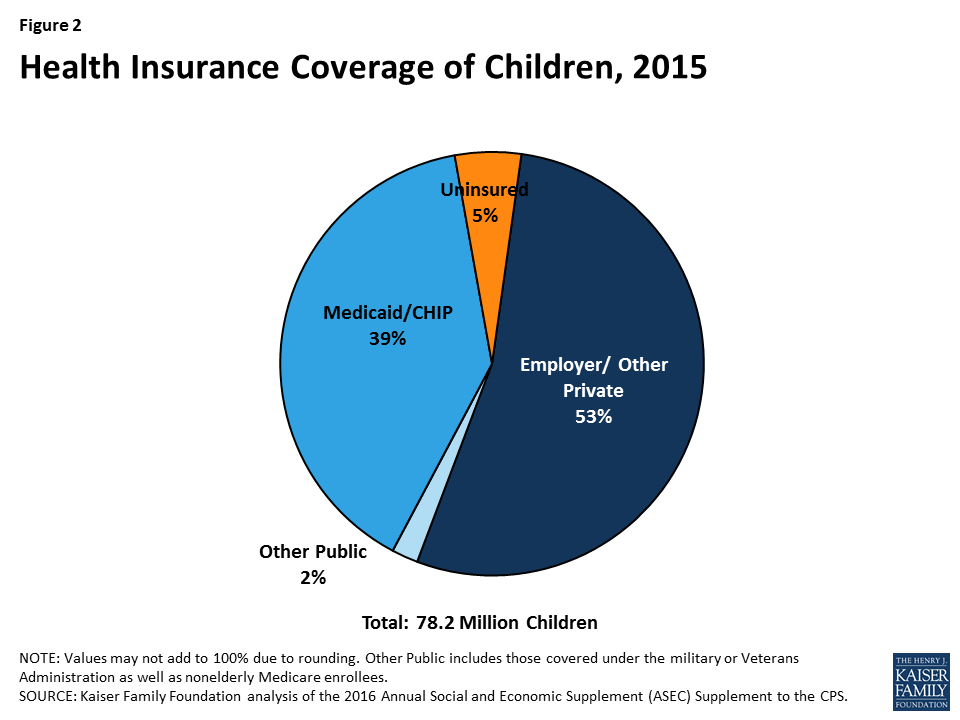

Key Issues In Children S Health Coverage Kff

Informed Consent Insurance Verification Form Superbill Physical Therapy Business Business Plan Template Business Plan Template Word

Mi S Infographic Starwood Hotels Marriott International Hotels And Resorts

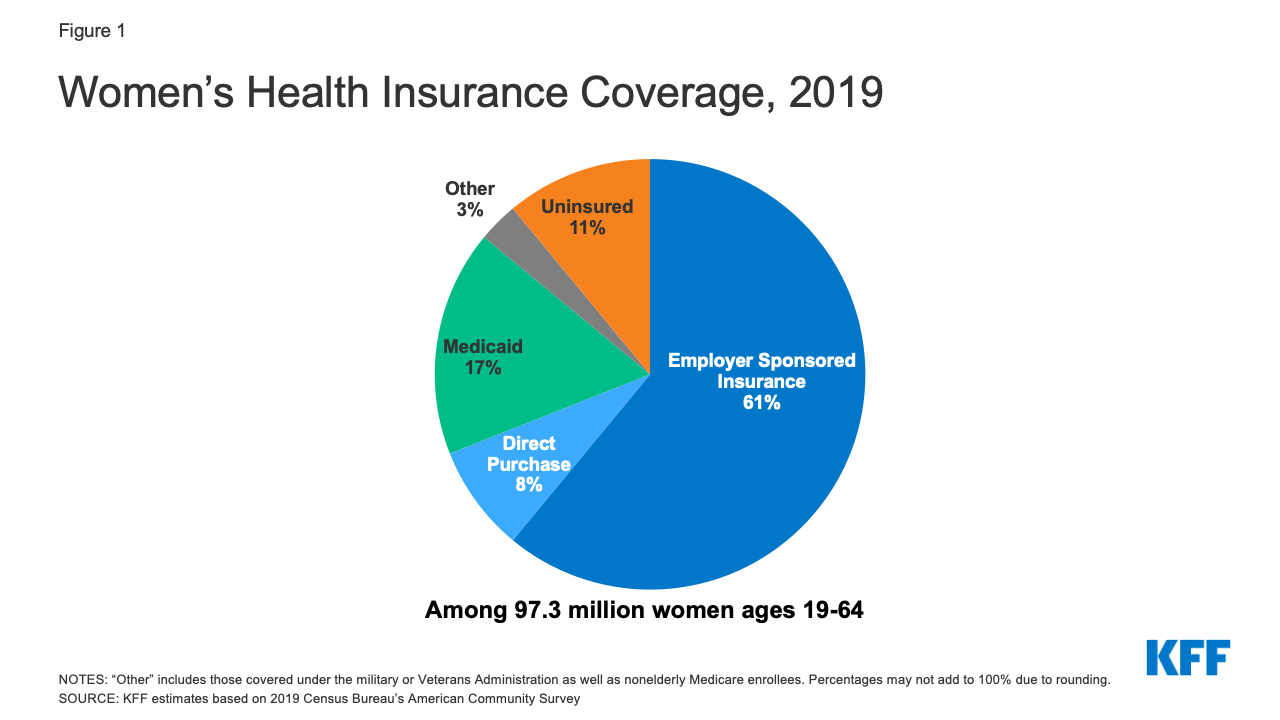

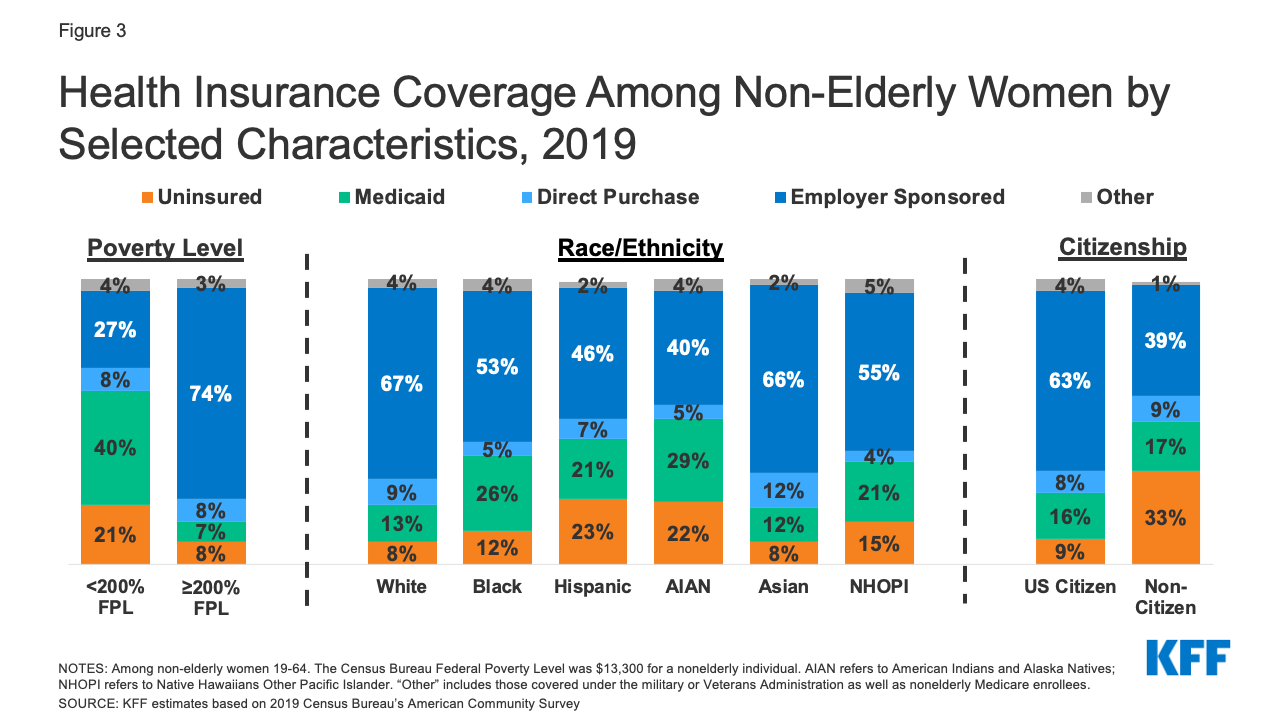

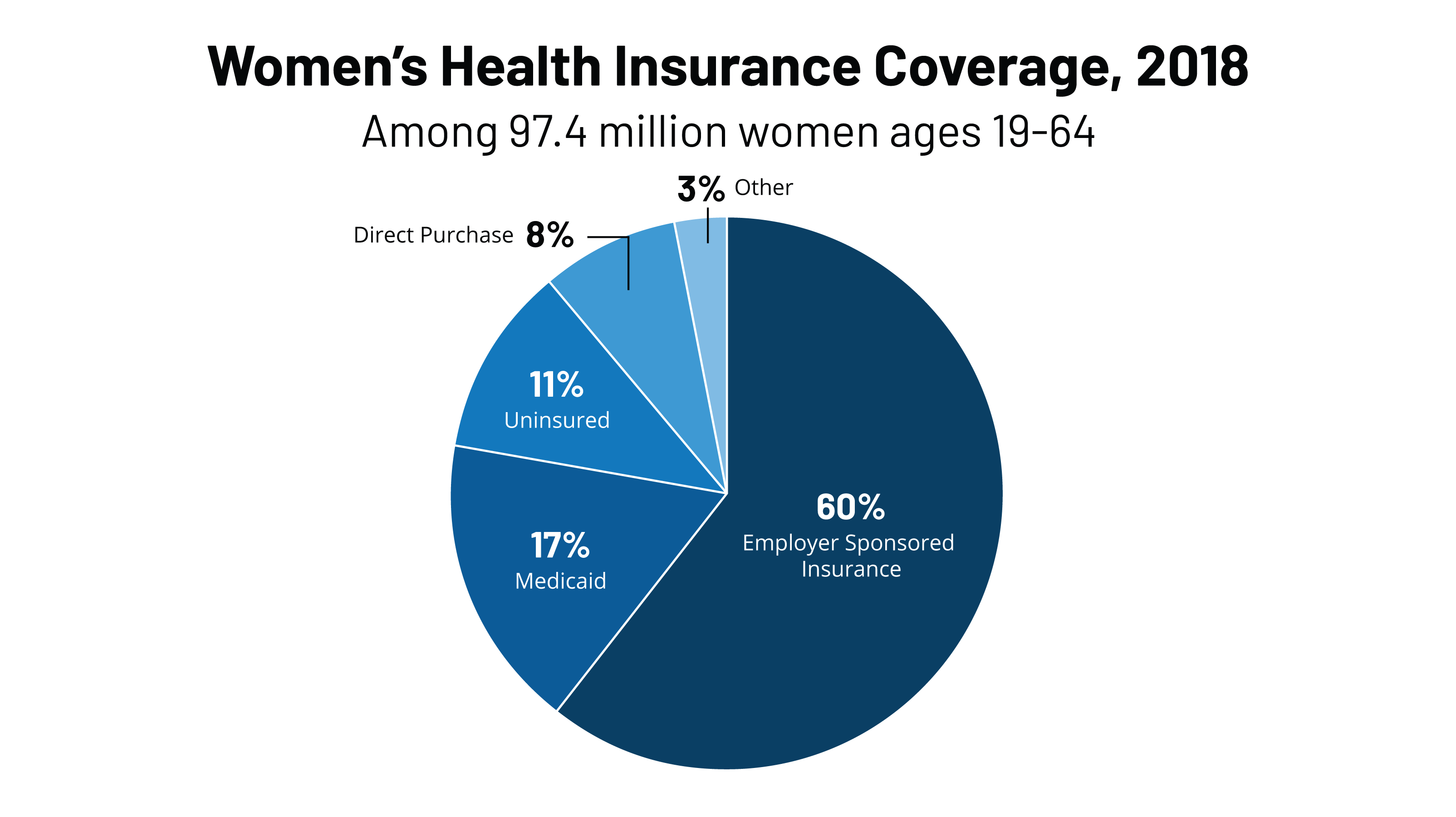

Women S Health Insurance Coverage Kff

2019 Commentary On First Half Financial Results Iii

Women S Health Insurance Coverage Kff

Combined Ratio Benefits And Limitations Of Combined Ratio

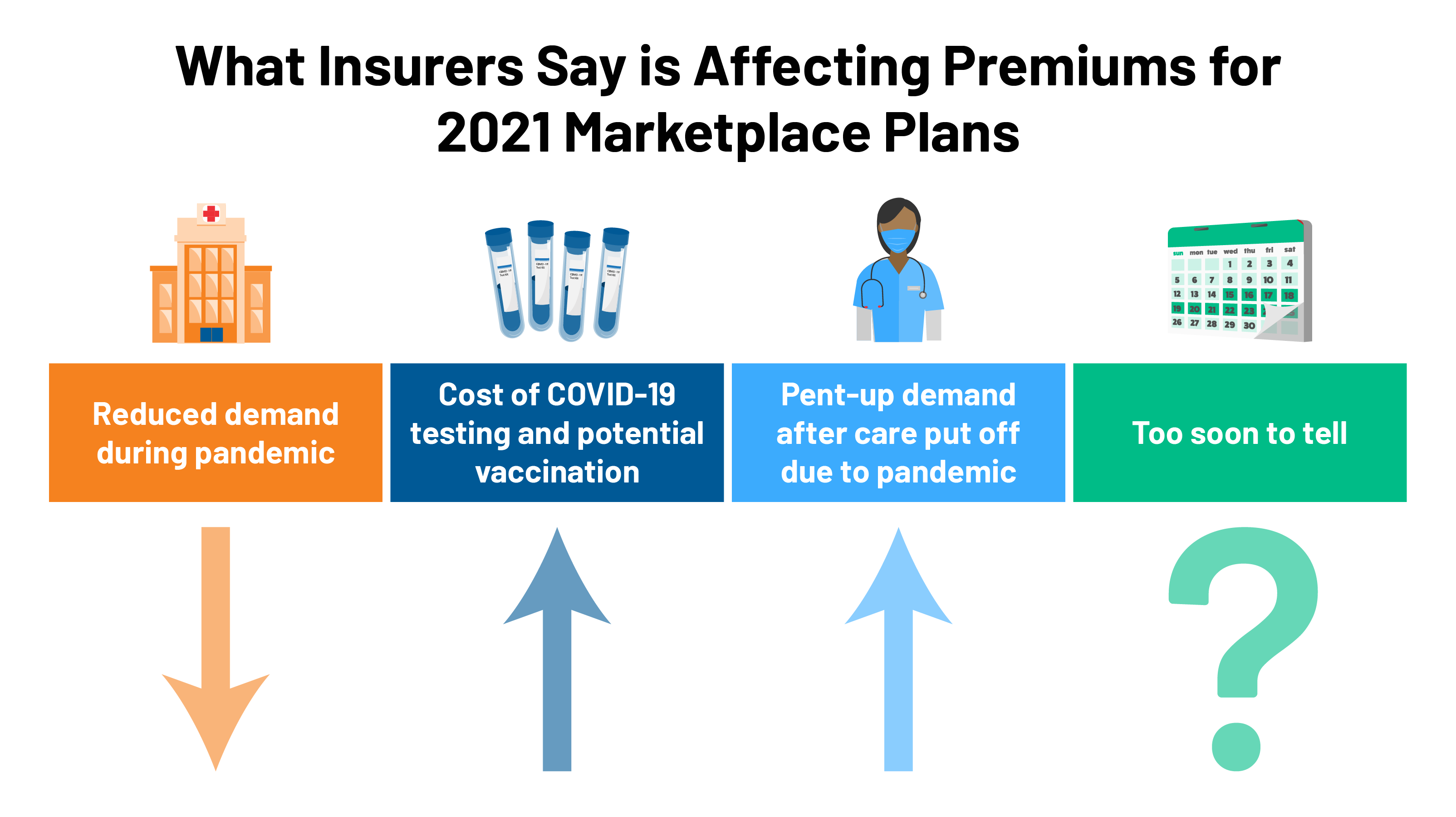

2021 Premium Changes On Aca Exchanges And The Impact Of Covid 19 On Rates Kff

Nsc 2018 Osha S Top 10 Violations For 2018 Ehs Today Osha 10 Things Violations

![]()

Tracking The Rise In Premium Contributions And Cost Sharing For Families With Large Employer Coverage Peterson Kff Health System Tracker

Get Our Sample Of Physical Therapy Business Plan Template For Free Physical Therapy Business Business Plan Template Business Plan Template Word

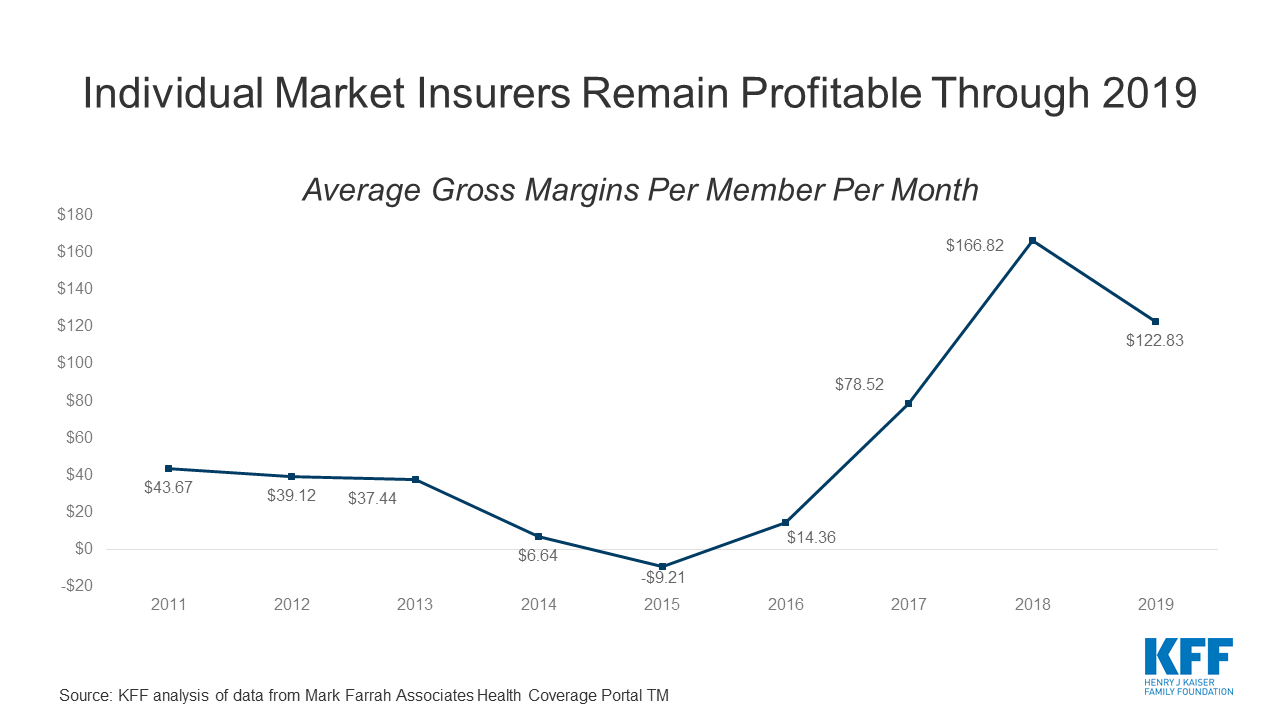

Individual Insurance Market Performance In 2019 Kff

Women S Health Insurance Coverage Kff

Many Insurance Plans Heap Healthcare Costs On Consumers Health Insurance Us News Healthcare Costs Health Insurance Plans Best Health Insurance

These Are The Most Uninsured And Underinsured Risks In America Report A J Longo Insuranc Small Business Insurance Business Insurance Life Insurance Policy

2019 Commentary On First Half Financial Results Iii

Posting Komentar untuk "Combined Ratio Insurance Coverage"