Does Aaa Insurance Cover Hit And Run

As the victim of a hit-and-run accident in Maine you may have to rely on your own insurance policy to cover the damage. You can file a claim with your own insurance company if you have uninsured motorist coverage but if you do not you will have to pay for the repair yourself.

Aaa Auto Insurance Review Quote Com

Switch to AAA Auto Insurance and save 376.

Does aaa insurance cover hit and run. Learn more about how insurance affects a car accident case. In this situation your car accident injuries would hopefully be covered under your health insurance. If you have underinsureduninsured motorist property coverage in your auto policy it may be able to help reimburse you for some of the damages from a hit-and-run.

While these coverage options are not legally required theyre fairly common. If you dont have collision or uninsured motorist property damage coverage your car will not be covered if damaged in a hit-and-run. It is especially important to file a police report on a hit-and-run incident.

In general it costs less than collision coverage. Learn more about auto insurance through AAA. If youre hit by an uninsured driveror if youre the victim of a hit-and-runyour uninsured motorist coverage can kick in to help pay your damages.

This coverage also protects relatives who live with you the occupants of your insured car and you as a pedestrian. What To Do in a Hit-and-Run In a normal traffic accident in which all drivers stop and stay on the scene you may have a moment to catch a breath and gather your thoughts before collecting the other drivers information contacting law enforcement and documenting any damage. With most insurance companies the answer is yes.

If you hit an animal only comprehensive insurance may cover your loss. If an animal strikes its whats called an act of God or act of nature Chatwin explains. And if youre hit by a driver with no insurance or worse youre the victim of a hit-and-run crash you get stuck with the bill for vehicle damage medical expenses lost time at work and a host of unexpected accident-related expenses.

Whether you are the victim of a hit-and-run or you were the one that panicked and sped off after hitting someone anyone involved in the situation may be left wondering what to do. You never know whats going to happen. If youre hurt or your vehicle is damaged in a hit-and-run your auto insurance policy may help cover the cost of car repairs transportation medical bills and other expenses involved in the incident.

If you live in one of those states youll need to add collision coverage to properly cover vehicle damage caused by a hit-and-run. Your collision coverage may also protect you if you are victim to a hit-and-run. UMPD cannot be used to cover hit-and-run accidents in a small number of states.

However collision insurance requires a deductible before coverage can kick in. This type of policy covers damage to your car and medical bills if you or any of your passengers get injured. Unless there is another party for your carrier to go after in order to recoup any damages ie- the deductible they will require you to pay the deductible out of pocket.

It covers medical bills as well as other expenses you might incur after an accident like lost wages or childcare. It would also include a hit and run such as if someone hit your car in a parking lot knocked off the side mirror and then fled the scene without leaving any information behind. Insurance may or may not cover your hit-and-run accident depending on your policy.

After any hit and run or any other type of auto accident report the incident to police and to your insurer immediately. Car insurance does cover hit and run accidents as long as you carry collision or uninsured property damage coverage. Howevera hit and run does not impact your driving record negatively and shouldnt impact your rates.

Unfortunately wildlife dont generally carry liability coverage so any damages will be your responsibility. That includes if the incident occurs in a parking lot. Does collision insurance cover hit-and-run collisions.

You can often claim the losses from hit-and-run accidents under collision coverage although the claim may raise your rates in the future if you choose to switch to a new company. If you have a basic bare minimum car insurance policy then you will not receive coverage for your hit-and-run accident. The scenario gets complicated if the damage was caused by a hit-and-run driver.

Like collision insurance personal injury protection covers you regardless of who was at fault in an accident and it may also cover you if you or your passengers sustain injuries in a hit-and-run. If your vehicle is leased or financed. If youve ever been the victim of a hit-and-run accident you may have experienced panic and confusion even downright anger.

According to the AAA Foundation for Traffic Safety 11 of accidents are hit and run accidents nationwide. Actual cash value includes depreciation and is the standard method of reimbursement for many insurance providers. Unfortunately even if the accident was not your fault be prepared to pay some out-of-pocket costs if your car suffered damage.

On the other hand causing a. Car insurance allows you. If youre the victim of a hit and run its important to consult your insurer.

Does Car Insurance Cover A Hit And Run Policygenius If you only have liability coverage your car insurance policy wont help you when it comes to injuries and vehicle damage caused by a hit and run driver. Comprehensive coverage typically covers auto losses that result from anything other than a collision with another car or objectfor example theft vandalism fire earthquake windstorm and other natural disasters. This coverage pays for injuries up to the coverage limit caused by a driver who is uninsured or an unidentified hit-and-run driver who is legally liable for those injuries.

But staying level-headed is essential -- especially when making a car insurance claim. Be aware that six states dont allow UM to cover repairs in hit-and-run accidents but motorists may pay those repairs through other coverage such as collision. This can also happen when an at-fault driver is underinsured.

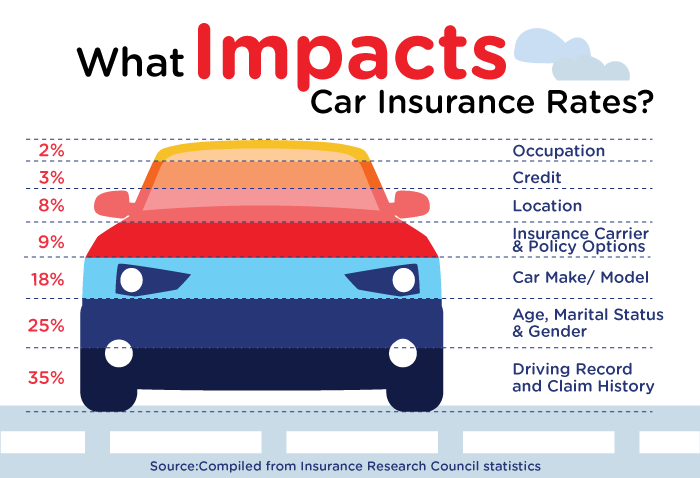

After any accident whats most important is. You may be covered. Anytime you are involved in a collision even a seemingly minor fender-bender it can impact your auto insurance.

If damage to your vehicle occurred when you were absent and no note was left your insurance company will treat it as a hit-and-run accident. It typically wont cover any hit-and-run costs. In California a hit and run accident where the driver is unidentified is treated by insurance companies as if it were an accident with an uninsured motorist.

Read Information On Take A Look Aaa Auto Insurance Quotes Just Click On The Link To Read More Collision Repair Auto Collision Car Insurance

Aaa Auto Insurance Reviews Rates Quotes 2021

Aaa Life Insurance Company Home Facebook

Common Auto Insurance Terms Explained

Aaa Auto Insurance Review 2020 Prices Benefits

Aaa Auto Home Insurance Review Strong Service And Decent Rates For Aaa Members Valuepenguin

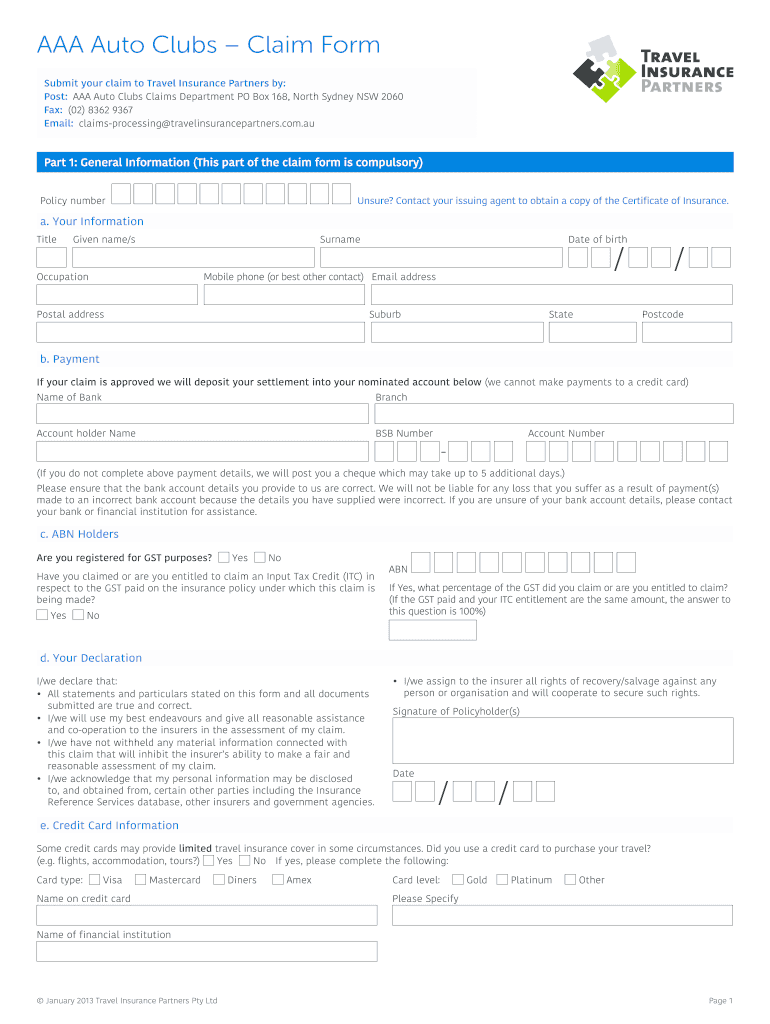

Aaa Claim Form Fill Online Printable Fillable Blank Pdffiller

Detailed Aaa Auto Insurance Reviews 2020 Policy Advice

Aaa Membership Can Help Save You Money On Insurance Us Insurance Agents

Aaa Auto Home Insurance Review Strong Service And Decent Rates For Aaa Members Valuepenguin

Everything You Need To Know About Aaa Auto Insurance

Aaa Roadside Assistance Is It Worth It Nextadvisor With Time

Aaa Auto Insurance Reviews Rates Quotes 2021

Aaa Auto Insurance Review Quote Com

Aaa Insurance 900 Miramonte Ave Mountain View Ca 94040 Yp Com

Aaa Insurance Claim Services Accident Assist

Aaa Auto Insurance Review Are The Extra Perks Worth It Finder Com

Posting Komentar untuk "Does Aaa Insurance Cover Hit And Run"